Complimentary Secure Offsite Backup

Sadly one of the trends we saw amongst our customers during lockdown was that of ‘lost data’, where a customer had lost access to their P11D information. Sometimes this was due to them trying to move an installation from one location to another to ‘take home’, sometimes it was because the laptop the took home […]

Read more

Is the end of the ICE age coming?

Electric cars are starting to become mainstream, and a combination of current events may speed the uptake even further.

Read more

HMRC encourages a shift to more environmentally-friendly vehicles.

It was announced by HMRC that company car drivers using zero emission cars will pay no company car tax in 2020-2021.

Read more

Voluntary Payrolling of Company Cars

If you have elected to voluntarily payroll company cars as a Benefit in Kind (BiK) via the HMRC, from April 2018 you will have to payroll your car data. It will be mandatory from this time to submit your car data information on your FPS (Full Payment Submission).

Read more

Revision in the P11D Organiser to accommodate for optional remuneration arrangements

The 2017 release has not been updated to reflect the comparison of the cash forgone to the modified cash equivalent of a company cars and other BiKs as discussed in the guide to optional remuneration arrangements.

Here’s why….

Read more

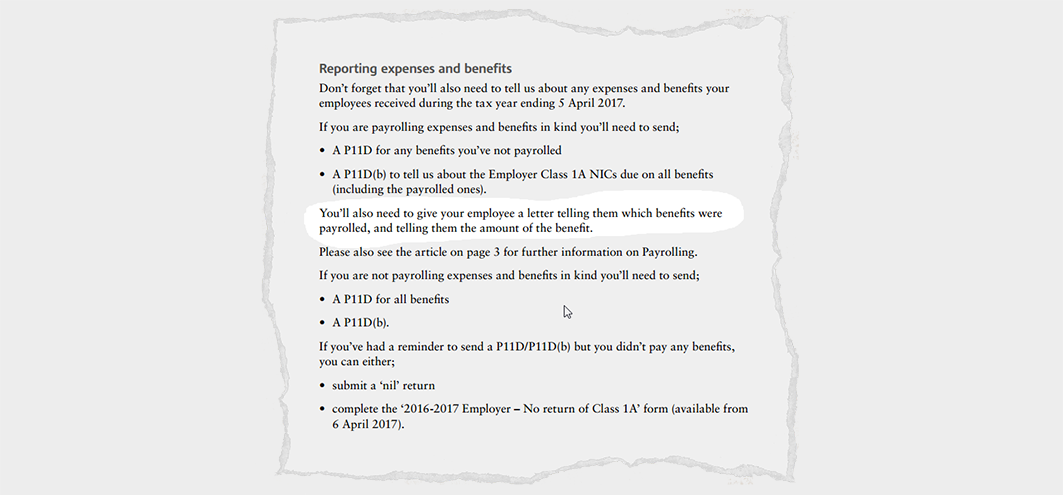

HMRC Reminder for those payrolling benefits

HMRC’s February issue of the Employer Bulletin (Number 64) contains a few important reminders for those employers that have payrolled benefits in the 2016-2017 tax year…

Read more

Treatment of non-deductible and non-exempt expenses 2016/2017

HMRC has provided further guidance on the treatment of non-deductible and non-exempt expenses in the October 2016 release of it’s Employer Bulletin.

Read more

P11D Organiser 2016 Released

We are pleased to announce the release of the 2016 version of the P11D Organiser. This new release contains a range of improvements to the way the software operates, as well as all the legislative changes necessary for the 2015-2016 P11D return process.

Read more

Trivial Benefits Exemption from April 2016

In February, draft guidance was published on a new exemption for low value benefits in kind (‘trivial BiKs’) to be included in the Employment Income Manual (EIM). The draft legislation for exemption for trivial benefits in kind is to be included in Finance Bill 2016 (FB16).

Read more

‘End of life’ for Internet Explorer 8, 9 and 10 next Tuesday

Internet Explorer 8, 9 and 10 are reaching ‘end of life’ on Tuesday the 12th 2016, meaning they’re no longer supported by Microsoft.

Read more