HMRC Reminder for those payrolling benefits

14/02/2017

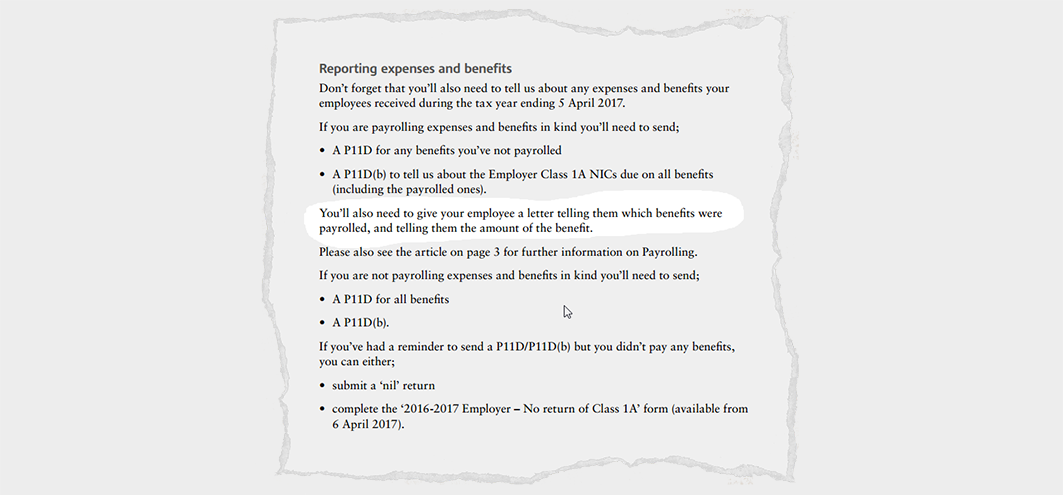

HMRC’s February issue of the Employer Bulletin contained a few important reminders for those employers that have payrolled benefits in the 2016-2017 tax year:

- A P11D must still be produced for an benefits you’ve not payrolled

- A P11D (b) still needs to be sent to HMRC informing them about the Employer Class 1A NICs due on all benefits (including payrolled ones)

- You’ll also need to to give your employees a letter telling them which benefits were payrolled, and telling them the amount of the benefit.

HMRC also noted that if an employer has had a reminder to send a P11D/P11D (b) but didn’t actually pay any benefits they still need to:

- Submit a ‘nil’ return

- Complete the ’2016-2017 Employer – No return of Class 1A’ form, which will be available from 6 April 2017